Every year, incorporated companies in Singapore would need to submit their financial statements with ACRA to ensure that the company’s information with ACRA is updated.

In 2020, ACRA (Accounting and Corporate Regulatory Authority) has come up with a new reporting format so that it’s easier for the government to analyse your data immediately. ACRA will now require for your financial statements to comply with the eXtensible Business Reporting Language filing system, or known as XBRL.

Not all incorporated companies have to file financial statements with ACRA. Those who do would need to file it according to a Full XBRL template, or a Simplified XBRL template and a PDF copy Financial statements.

Who needs to file? Who is exempted?

All Singapore (SG) incorporated companies are required to file financial statements (FS) with ACRA, except for those which are exempted. Some companies will file a full set of FS in XBRL format, while some others will file key financial data in XBRL format and a full set of signed copy of the FS tabled at annual general meeting and/or circulated to members (AGM FS) in PDF. If you own a sole proprietorship, partnership, limited liability partnership, or limited partnership, you are not required to file FS with ACRA.

Not all companies need to file financial statements (FS) to ACRA.

You are exempted from auditing your financial statements if your company:

- Has an annual revenue of S$10m or less

- Has total assets of less than S$10m

- Does not have more than 50 employees

If your company does not fulfill the above conditions, you need to file your financial statements to ACRA.

What does small company means?

Your company is small when your revenue and total assets for the current financial year does not exceed $500,000 respectively.

Benefits of using XBRL

It supports transparency and increases capital markets efficiency by helping users of business and financial information and analysts find relevant information. XBRL facilitates the confluence of accounting standards by the ability to align financial concepts among public taxonomies.

What is XBRL Format?

The term “XBRL“ is an acronym for the eXtensible Business Reporting Language. It is an XML-based language and is used to standardise the format of filing of the financial statements.

XBRL is a form of reporting language adopted by ACRA. The companies that are required to lodged accounts with ACRA must use XBRL format for reporting their financial statements.

The difference between Full and Simplified XBRL Template

Full XBRL template

This captures information in primary statements.

Simplified XBRL template

This captures the complete information in the statements of financial performance and position.

What makes up a “full set” of financials?

Based on the financial year that’s just passed, or one that’s ending, you should include the following documents as part of the full set of financials that are submitted:

- Statement of financial position: This covers assets, liabilities and company equity. It’s also referred to as a balance sheet.

- Statement of profit or loss: This should cover comprehensive income, company financing costs, capital gains and losses as well as revenue.

- Changes in equity: This statement includes things like transactions among shareholders or amends to classes of shares you’ve issued, as well as any amends to your company’s share capital, dividends declared and other things that affect equity.

- Cash flow: This statement includes any cash (or cash equivalents) that flow in or out of the company as a result of any investing, operating or financing activities.

- Financial notes or comparative information: Any additional information from auditors or directors that may serve as helpful and/or explanatory.

How to prepare and manage XBRL financial statements

Once you have successfully prepared and filed financial statements in XBRL format based on similar filing requirements in the first year, it gets easier to prepare the financial statements in XBRL format in subsequent years.

There are 3 ways to prepare your financial statements using XBRL:

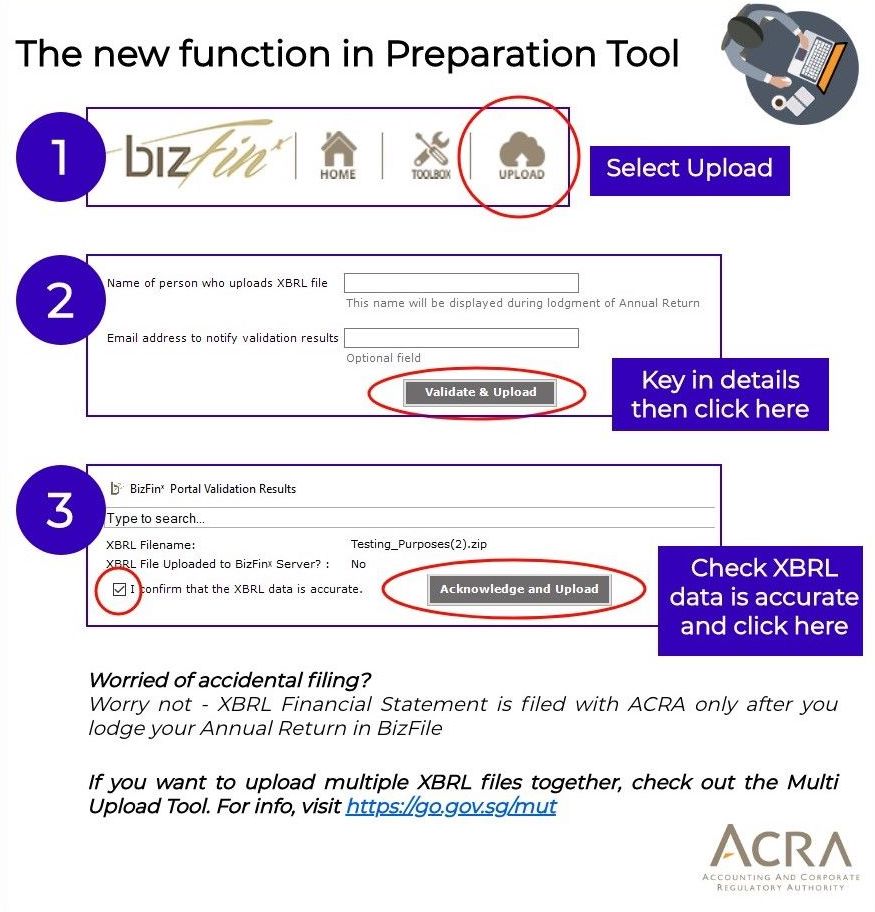

1. Use the BizFinx preparation tool and file your annual return through the BizFile+ portal. We list the steps for this below.

OR

2. Use accounting software that can seamlessly prepare and file your annual return (with Simplified XBRL FS) to ACRA.

3. If you want a trusted accountant with the ability to help you when you get overwhelmed, reach out to us to help prepare your XBRL Financial Statements.

How to prepare and manage XBRL financial statements

Retrieve the financial statements tabled at your company’s annual general meeting (AGM FS). This is referred to as the “source document” in the preparation tool, which can be in either Microsoft Word or Microsoft Excel formats.

Map the line items in your financial statements to the relevant tags within the ACRA Taxonomy. Complete all tabs in the template. Leave the data fields blank only if the information requested is not disclosed in the AGM FS.

When completed, validate your XBRL FS offline. Review and correct the errors highlighted, if any.

Validate and upload your XBRL FS directly from BizFinx preparation tool.

When do I need to start filing according to the new XBRL template?

Your company is required to do so after 1 January 2021. However, from 16 May 2020 to 31 December 2020, you can voluntarily prepare your annual returns using the XBRL templates.

Recap of what documents to file for your annual return

- Audited financial statements: When you’re submitting your Annual Return with ACRA, you’ll also need to attach your company’s audited financial statements.

- Annual Return date: This is usually based on one of the two; the date you last filed your Annual Return, or a year following the official incorporation of your company.

- Deadline: Whether you are filing your Annual Return or you are getting the assistance of a third-party, make sure to get it done no more than 28 days after its due.

XBRL is an ideal option for:

- Improving the Proficiency of Business

- Refining Reliability with Detailed Financial Reporting

- Accurate Transparency

- Prompt Circulation of Data

- Swift Dissemination of Important Monetary Statistics