GST, a term commonly heard in Singapore, when you shop, dine out, or do anything within the country. But what exactly is GST? As a new business, what are some important points that you need to note about compliance and GST in Singapore?

Today, we will be diving into the topic of GST, how it will affect your compliance, and why it matters.

What is GST?

GST, also known as the Goods and Services Tax, was first implemented on 1st April 1994. The concept of GST is modelled after the UK VAT and New Zealand Goods and Services Tax legislation.

The entity that oversees and ensures compliance of GST is the Inland Revenue Authority of Singapore (IRAS). This organization acts as an agent on behalf of the Singaporean government, to collect, administer, assess, and enforce Goods and Services Tax payment.

GST is a consumption tax levied on the supply of goods and services and importing of goods into Singapore. Currently, a GST of 7% is applied on the selling price of all goods and services provided by registered business entities in Singapore. This tax is passed on to the end consumer and does not contribute to any costs in a business. Businesses merely act as a collecting agent and pass on the taxes collected to the Singapore Tax department.

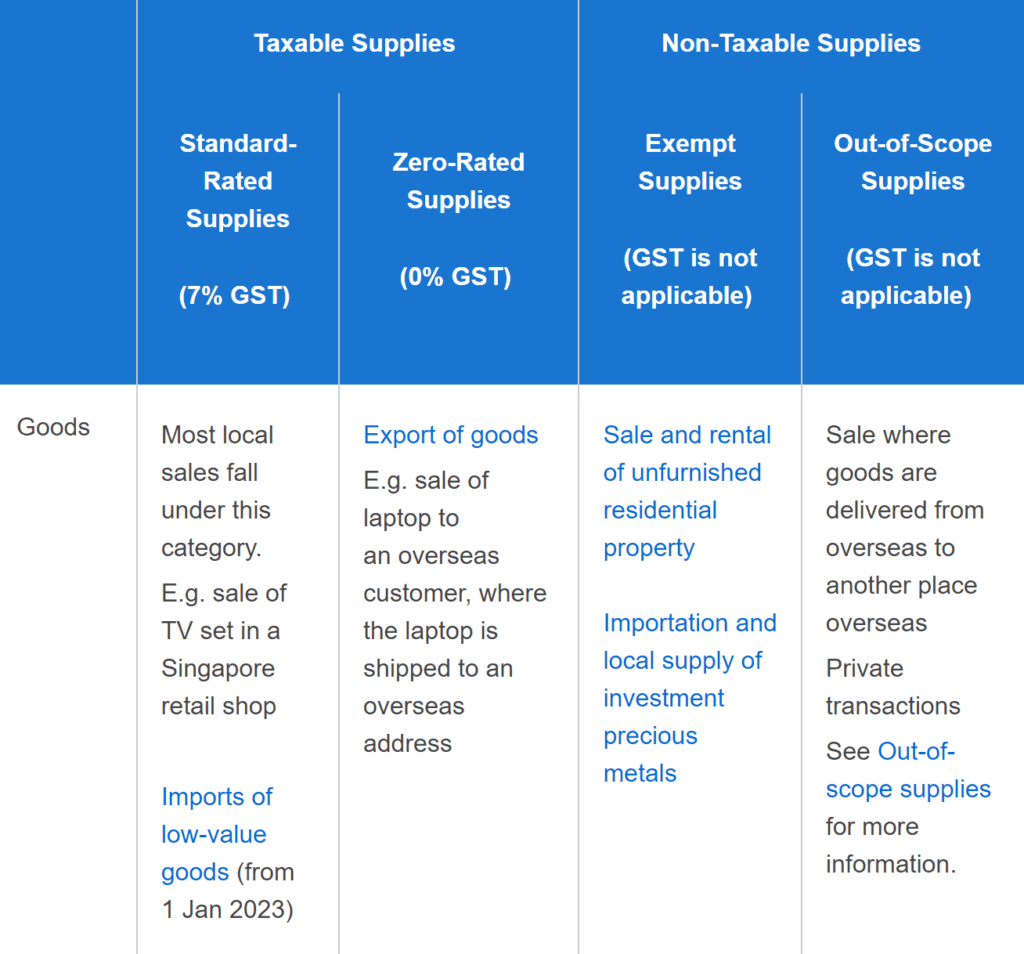

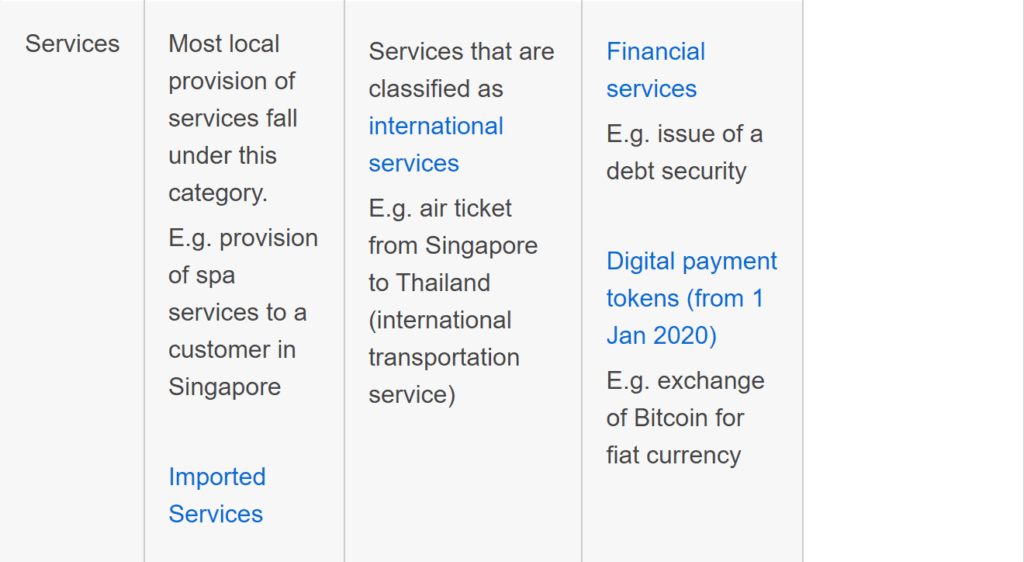

What are some examples of taxable and non taxable goods and services?

With reference to the information posted on the IRAS website, this is table simplifying the goods and services that are taxable and non-taxable.

How does GST affect companies in Singapore?

GST registered companies will need to collect Goods and Services Tax from their customers for the goods and services offered. Thereafter, this tax money is to be passed on to the tax authorities on a quarterly basis via tax filing.

Not every incorporated company is automatically a GST registered company. Only when certain conditions are met, are companies required to apply to IRAS to become a GST registered company. Subsequently, the Goods and Services Tax will be charged on their goods and services, and they are legally obliged to collect these tax monies.

Does my company need to register for GST?

Every company will be required to perform continuous self-assessments to determine the need to apply for tax registration. There are 2 main categories when it comes to GST registration, namely:

1. Compulsory Registration

Companies are legally required to register for GST when:

- Business turnover is greater than S$1 million in the past 12 months.

- Company is generating sales that is expected to exceed S$1 million in the next 12 months. This includes all agreements/contracts signed.

If any of the above criteria is fulfilled, companies are expected to submit the GST application to IRAS within 30 days. Failure to do so will result in penalties.

2. Voluntary Registration

Alternatively, companies who have not fulfilled the terms of compulsory registration can choose to voluntarily register for GST. To do so, the business must have plans to do sales or has already conducted sales activities within Singapore to be taxable.

There are secondary conditions if a company decides to voluntarily register for GST such as:

- Company must remain registered for at least 2 years.

- Have to comply with the GST regulations throughout.

- Required to file GST return timely (quarterly basis).

- Mandatory to maintain all records for at least 5 years, even after business has ceased or business has deregistered from GST.

- Other additional conditions may apply depending on the nature of your company.

Exemptions from GST registration

There are businesses who can file for the Goods and Services Tax registration exemption. However, this is only if your business meets these criteria:

- More than 90% of your total taxable supplies are zero-rated.

- Your input tax is greater than your output tax.

GST de-registration

A business is also allowed to de-register for the Goods and Services Tax if they meet any of the 3 criteria mentioned here:

- Business has ceased operations.

- You have sold your business as a whole to another person/company.

- Sales figures do not exceed S$1 million.

The de-registration process is similar to the registration process. Businesses who wish to de-register are required to submit an application form with the supporting documents within 30 days from the cessation date.

If my company does not need to register for GST, are there any benefits to registering?

Of course, with every decision comes a set of pros and cons, which we will be discussing in this section.

Pros

- Increases the credibility and reliability of your business. All large business establishments are required to register for this tax. This association could give your business a boost in reputation, signaling to customers that your business is of relative size.

- Lower cost of business. Goods and Services Tax registration allows companies to claim the taxes they paid when conducting business operations. If your supplier is GST registered but you are not, you will be paying suppliers this tax amount. However, in the same situation, if you are GST registered, you will be able to reclaim the taxes you paid.

Cons

- Greater administrative burden. You will need to submit quarterly tax filing reports which could be a huge burden on your company if you have inadequate resources. Also, if you do not have skilled personnel who understands the tax system well, you will need to outsource this work.

- Increase in selling price of your goods and services by 7%. Although your costs may be reduced, your customers may not be happy with the increase in prices. You will need to consider the price elasticity of your consumers before making a decision.

Having troubles coming to a conclusion as to whether or not to voluntarily register for GST? Or are you having issues sorting out your tax?

This is where you can Count On Me! Our skilled and knowledgeable senior accountants are here to provide you with tax advisory services and help you achieve your goals.

If you are new to accounting and finance, and is looking to broaden your horizons around this topic, we have other articles for you to check out: